By Paul Moxey, Visiting Professor in Corporate Governance at London South Bank University

Internal audit should get more involved in evaluating corporate governance. Governance should be seen as the enabler of good organisational performance so evaluation should look at how well governance is contributing to good performance. This is a great opportunity for internal audit to play a greater part in improving organisational effectiveness.

The term corporate governance is now probably as embedded in the public sector as it is in the listed company sector. Before 1992 hardly anyone had heard of the term, now a whole industry has evolved around saying what it is, what should be done and who should do it and how. Corporate governance used to have one simple generally accepted definition – the system by which organisations are directed and controlled. Now there are lots of definitions and anyone new to the subject could easily be confused about what it is. Even experts in corporate governance disagree and few are concerned about what it is for.

My contention is that corporate governance has become too focussed on compliance with governance requirements rather than how governance contributes to organisational performance. That focus needs to change.

We need to expect more from corporate governance. We need to know that it is being useful and that it is working. If we take governance as the system by which organisations are directed and controlled it follows that, if an organisation has good governance, it is well directed and controlled. If it is well directed and controlled it follows that the organisation will be working efficiently, economically and effectively in pursuit of the purpose for which it exists. If for example it is a hospital it will be looking after its patients and making the sick better. Efficiently, economically and effectively for a hospital are insufficient and we should perhaps add ‘caringly’. Corporate governance should be judged on how well the organisation is fulfilling its purpose and how well its top layer of director or management is working to ensure the organisation is doing this.

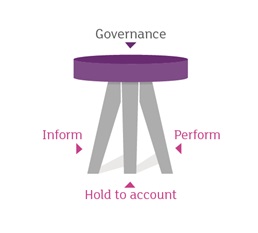

This requires a different approach to corporate governance. For governance to work three things are needed. The organisation and those in it need to perform, those responsible for performing need to inform or demonstrate that they are doing so and those to whom the performers are accountable need to be able to hold the performers to account. It is like a three legged stool. If governance is the seat of the stool, these three elements – performing, informing and holding to account are the three legs. Each needs to be sound. If one is missing or broken governance cannot work and if one or more legs is wobbly governance cannot work well.The governance system needs to ensure that all three legs are sound. How will we know if governance is working well? Someone needs to evaluate the performing, informing, and holding to account. The person to do this is the internal auditor. There has been debate for years about whether and how internal audit should be involved in corporate governance. As early as 1990s internal auditors in the NHS were expected to opine on governance but the work done was often rather superficial and carried out by people who lacked a real understanding of governance. After each crisis in the private sector people ask where was the internal auditor? Too often the answer was it was not part of their job.

In the private sector there has been a certain reluctance to get involved. It is potentially risky for internal auditors to investigate and give an opinion on what could be a very sensitive matter in an organisation when governance is not very good. It is however a challenge which internal auditors should be willing to accept. The prize for doing so is that internal audit will be seen as more relevant and valuable to an organisation and play a bigger part in helping to ensure that organisations are well governed and economically, effectively, efficiently and caringly performing. That should have the side benefit of making the job more satisfying and rewarding. Work will be needed in developing a suitable audit methodology, who is willing to get started?

- Paul spoke at the CIPFA Internal Audit Conference in May in London. He also delivered a pre-conference management development session on culture and behaviour.