At the heart of strong public financial management is a pool of talented finance people – both the experienced accountants and the millennials who are key to the future of the public sector. We also know from our conversations with public sector organisations around the world, whether we look to developing or developed countries, that attracting and retaining finance talent is a challenge.

With automation, artificial intelligence, and blockchain all promising to bring big changes to how we undertake financial management, audit and accounting in the future, the public sector needs to must make sure they have the right talent to adapt. This is why CIPFA, on behalf of the International Colloquium on Financial Management for National Governments, surveyed 72 public sector organisations around the world to better understand the challenges in building sustainable talent.

The report we’ve developed from our research ‘Talent management in government finance’ is a world first, and should kick off a much needed conversation about talent management strategies, and provide an initial evidence base from which we can start to develop a truly sustainable workforce for public financial management.

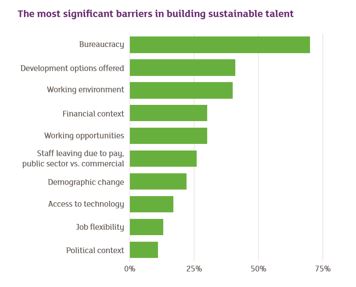

Among the results, we found government has ‘category issues’ to overcome in attracting the best talent to its workforce. Respondents highlighted how bureaucratic processes, organisational conservatism and lower pay with respect to corporate alternatives all contribute to negative perceptions of careers in government. Conversely, government’s relative terms and conditions, not least its pensions, job security, a supportive culture, and the uniquely challenging complexity and variety in the roles available, could – with the right emphasis – far outweigh the perceived drawbacks.

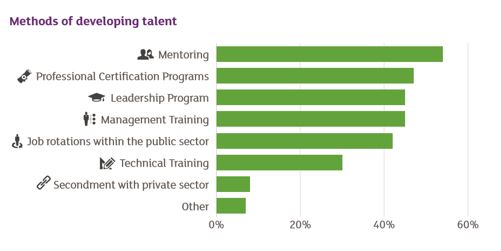

What this highlights is the increasing importance for the public sector to be agile when it comes to managing, developing, and retaining financial talent. Partly this means ensuring finance teams get the chance to explore continuing professional development (CPD) opportunities, which are critical to engagement and retention strategies in any profession. Whether you are providing mentorship or secondments, government employers need to make sure they are providing their finance teams with timely and relevant opportunities which support individuals at differing stages of their careers.

However, supporting CPD is not the only key to drawing in and retaining talent, and this was highlighted by the organisations we talked to. Whether its work life balance, job stability, the public sector ethos – or for organisations thinking ahead, arrangements like home working and flexible hours – in a competitive job market, these dynamics can make all the difference to attracting fresh talent into the public sector.

This research also shows how in the next ten years the public finance professional will need to take on more complex skills and undertake an increasingly strategic role, focusing on planning and resourcing. They will need to understand and encompass digital technology, exponential growth in the availability of data and adapt to changes in work practices. Making this happen requires getting the strategies in place now. If the finance profession in government can get this right, it can build a high performance workplace, encourage a learning environment and contribute to a more diverse workplace.

Talent Management in Government Finance is available to download as a PDF report.

This article first appeared in Public Finance.