By CIPFA Chief Economist Jeffrey Matsu and Phil Woolley, Partner, Grant Thornton

Local economies have struggled under lockdown and this is impacting the financial stability of local authorities. Phil Woolley and Jeffrey Matsu, Chief Economist at the Chartered Institute of Public Finance and Accountancy (CIPFA), look at the impact of COVID-19 on local economies, the financial sustainability of local government, and the interdependencies between the two.

Public finances are facing historically significant challenges. Due to the unprecedented level of support provided by the government in response to coronavirus, the most-recent figures show that government borrowing exceeded £208 billion between April and September 2020, compared to £31 billion in the same period last year, reaching the highest level ever recorded .

While the unprecedented levels of financial support from government to councils are very much welcome, these have been one-offs. With conflicting public service priorities, there is uncertainty over whether there will be growth to funding levels going forward. Even if the funding for 2021/22 is rolled forward to levels originally received this year, it won’t meet the current need arising from changing demographic trends and demand pressures.

In an earlier article, six months after the introduction of lockdown, we discussed the impact this has had on local government expenditure, income and financial planning. Since then, we've seen a further restrictions and a second lockdown, as well as a greater recognition from government of the need to collaborate with local authorities to agree on the correct way forward. There hasn't always been consensus, most notably in Manchester, and there are always likely to be different views on how to correctly balance the risk to public health with the financial damage to business.

The decision to move forward with a one-year spending review, while understandable under the current circumstances, makes medium-term financial planning difficult. Spending reviews provide the discipline for departments and local authorities to spend within their means and plan accordingly, and tough decisions can be postponed, but to ignore them completely would be at the government’s peril.

How local authorities can chart a path through uncertainty

The impact of COVID-19 is likely to be lasting and widespread. For local authorities, there are a number of factors at play, including:

- rising demand for mental health and domestic abuse support

- an over-stretched NHS, resulting in a worsening of wider health outcomes as many treatments are delayed

- rising unemployment and poverty levels

- reduced business-rate tax bases

- ongoing reductions in car parking income

- rising demand for children’s social care

- the exponential rise in online shopping impacting high streets.

While there will be some opportunities arising, such as greater use of online service delivery channels, carbon reduction and property portfolio optimisation, these will need to be fully understood before they can be realised.

Coronavirus has demonstrated just how powerful and important up-to-date and reliable data can be in organisational decision making, but local authorities have the challenge of balancing fast and slow data. Fast data can indicate what is happening to aspects of the local economy, but not why it is happening; for example, business sentiment surveys or traffic and mobility indicators. Meanwhile, slow data, such as GDP or inflation can provide context and depth, but not in a timely way.

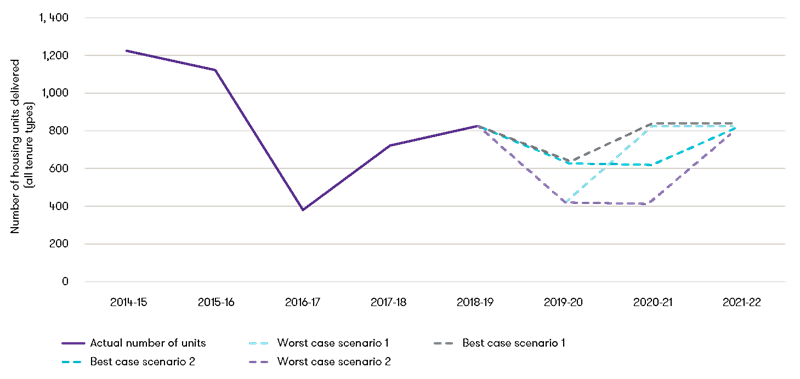

To understand the ongoing impact on local population and businesses, local authorities must first understand the difference between where they were before coronavirus and what the outlook is for the future. For example, as people begin to change how and where they work, councils will need to model what this may mean for future housing supply to ensure they plan appropriately. By extension, this would affect the type of housing stock and tenures that would be required as well.

Example scenarios for housing demand for an example local authority

Source: Grant Thornton analysis of housing delivery numbers in the UK

Understanding local business make up and how different sectors have been impacted will be critical in managing the ongoing response to the coronavirus lockdown. Mounting cost pressures and reduced income will necessitate more-targeted government support schemes to provide for those impacted by economic disruption.

Indeed, the government's levelling-up agenda across regions and communities would benefit from better-attuned, place-making strategies that consider digital access, ethnicity, housing tenure, determinants of health and employment type. Financial resilience and sound public financial management need to be at the core of decision making today to impart financial sustainability for the future.

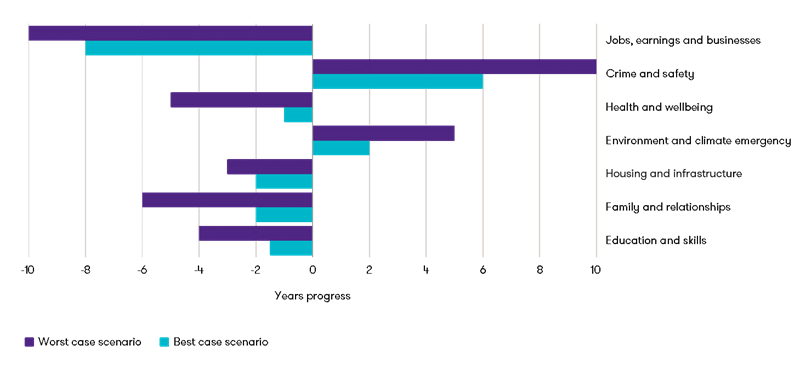

Data and forecasting are invaluable tools and it will be important to understand the scenarios at play. The example below shows how lockdown has impacted a set of broad outcomes to date, in a potential worst- and best-case scenario. More specifically, it illustrates how this has either set back or improved progress across a range of policy areas.

COVID-19 impact on outcomes for an example local authority

Source: Grant Thornton analysis

Once up-to-date and reliable data have been used to create forecasts and scenarios, local authorities may start to make better-informed judgements relating to economic recovery plans and, in turn, the priorities that inform resource allocation in their medium-term financial plan.

There is a growing consensus that, when looking at international responses to coronavirus, those countries with local approaches to decision making and service delivery have been more effective than those with more-centralised approaches. In the absence of a decentralised system and appropriately resourced local infrastructure in the UK, local authorities will be reliant on doing more with less, utilising a range of data and forecasting techniques as part of their medium-term service and financial planning.

Find out more

View: Grant Thornton and CIPFA discuss financial planning and stability for local authorities