by Lisa Forster - CIPFA Finance Advisor

The current economic climate in the public sector has led to organisations needing to become leaner, meaner and more commercial. For accountants this can be an opportunity to expand their role and provide critical insight and business intelligence to optimise service and organisation outcomes. This involves building on the traditional role of focusing on control and ‘number crunching’ to one that adds value by offering insights to help decision makers understand the financial implications of strategic and policy options.

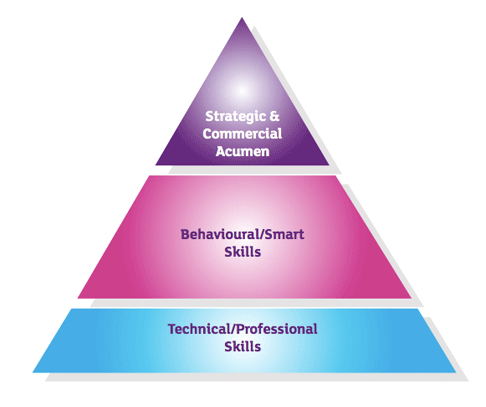

To do this the successful finance business partner (FBP) will need to master a variety of skills - as illustrated by the diagram below.

The foundation or core of the FBP is still the traditional technical skills such as forecasting, budgeting, option appraisal and costing. However added to this are behavioral or smart skills which involve being able to effectively engage and communicate across the organisation. If the FBP is unable to clearly and succinctly communicate their insights and explain how these will support the rest of the organisation, then the effective use of professional/ technical skills is diminished. It is often these quantative or soft skills that are the most difficult to develop, and are sometimes outside an accountants comfort zone.

At the top of the pyramid are strategic skills and commercial acumen. In the current financial climate this is an area that is critical to the success and sustainability of any organisation.

In addition to all this the effective the FBP must have knowledge of the service terrain and its challenges, if they don’t understand the business they can’t make valuable insights.

Whilst all of this may sound straight forward there are internal and external barriers that need addressing. The internal factors include a lack of investment in training and development to equip traditional accountants them with the wider skills required. The external factors include a lack of engagement, insufficient investment, and an inward looking perspective that isolates the change within the finance function without an appreciation of the aim and objective of the change. To overcome this there needs to be a top down appreciation of the role, a proactive approach to resourcing and a cultural shift that wins the hearts and minds of all involved.

CIPFA believes an effective FBP is an essential role in moving forward and building a more sustainable public sector in the future. We have already produced a publication on this (including one for those in the NHS) and in April we launch our new post graduate certificate in finance business partnering.